Demand for Bone Densitometers in UK 2026–2036: Steady Growth Driven by Prevention and Diagnostic Capacity Expansion

England’s healthcare growth hits 4.7%, driven by larger networks, higher scanning demand, and expanded fracture risk assessment pathways.

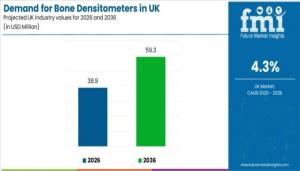

NEWARK, DE, UNITED STATES, January 21, 2026 /EINPresswire.com/ -- Demand for bone densitometers in the United Kingdom is projected to reach USD 38.9 million in 2026 and is forecast to grow to USD 59.3 million by 2036, expanding at a compound annual growth rate (CAGR) of 4.3% over the ten-year period. This growth reflects how hospitals, diagnostic imaging centers, and specialty clinics are scaling bone density screening capacity to support osteoporosis risk assessment, fragility fracture prevention programs, and long-term bone health monitoring.

Bone densitometry is increasingly positioned as a decision-support tool within structured care pathways. Rather than being treated as a standalone diagnostic, bone density measurement is integrated with fracture risk assessment to guide treatment initiation, therapy monitoring, and follow-up cadence. As healthcare providers work to reduce avoidable fractures and improve outcomes in aging populations, densitometry capacity planning has become a consistent operational priority.

Discover Growth Opportunities in the Market – Get Your Sample Report Now

https://www.futuremarketinsights.com/reports/sample/rep-gb-31654

Market Snapshot: Bone Densitometers Demand in the UK

• Market value (2026): USD 38.9 million

• Forecast value (2036): USD 59.3 million

• Forecast CAGR (2026–2036): 4.3%

• Leading region: England (4.7% CAGR)

• Leading product: Axial bone densitometers (61.4% share)

• Leading technology: DXA (52.0% share)

• Leading end user: Hospitals (43.5% share)

Why Demand Is Building Across UK Healthcare Systems

Demand growth is shaped by a stronger clinical emphasis on earlier diagnosis of low bone density and structured osteoporosis management. Clinical teams increasingly rely on fracture risk assessment tools to determine which patients benefit most from measurement, then use bone mineral density (BMD) results to support treatment decisions and long-term monitoring.

National clinical guidance reinforces this approach by outlining assessment and management pathways that combine fracture risk evaluation with BMD measurement. As patient awareness improves, referrals for DXA scanning are rising, increasing pressure on providers to ensure timely access and consistent reporting. This dynamic is particularly visible where primary and secondary care pathways aim to shorten the time between risk identification and formal diagnosis.

From a procurement perspective, hospitals often align densitometry capacity planning with broader diagnostic device strategies. Imaging leaders standardize performance benchmarks around reproducibility, throughput, and reporting quality, particularly when scaling services across multiple sites.

How Providers Evaluate Bone Densitometry Systems

Across the UK, purchasing decisions are shaped by operational reliability rather than experimental innovation. Providers assess systems based on:

• Scan reliability and reproducibility across operators

• Workflow throughput and scheduling stability

• Image quality and reporting consistency

• Integration with clinical decision-making processes

• Service support, calibration discipline, and training readiness

For hospital leaders, the central question is access: how quickly patients can be assessed and how reliably results can inform care pathways. Imaging center operators place added emphasis on uptime and predictable service support, as scanning slot disruptions directly affect revenue and patient satisfaction.

Product and Technology Segmentation Reflects Clinical Priorities

Axial bone densitometers account for 61.4% of demand, reflecting their role in measuring key skeletal sites such as the hip and spine. These sites are central to osteoporosis diagnosis and monitoring, making axial systems the preferred choice for high-confidence assessment programs. Their alignment with standardized protocols also supports consistency across operators and sites.

On the technology side, DXA systems hold a 52.0% share, maintaining their position as the leading modality. DXA remains widely used because it delivers quantitative bone density measurements that integrate effectively with fracture risk assessment frameworks. Established training pathways, familiar reporting standards, and predictable workflows reinforce DXA’s role in routine clinical practice.

Hospitals Lead Utilization, with Imaging Centers Supporting Access

Hospitals represent 43.5% of total demand, driven by higher patient volumes and their role in managing structured osteoporosis and fracture liaison services. These settings prioritize systems that support long-term utilization, stable throughput, and multidisciplinary integration.

Diagnostic imaging centers play a complementary role by reducing referral bottlenecks and offering dedicated scanning capacity. Specialty clinics contribute through targeted monitoring programs, often emphasizing rapid access and convenience for specific patient groups.

Market Dynamics, Constraints, and Opportunities

Key demand drivers include:

• Expansion of fracture prevention programs

• Structured osteoporosis care pathway development

• Increased use of fracture risk assessment tools

• Operational focus on reducing avoidable fractures

Constraints affecting adoption include:

• Competition for capital budgets across diagnostic equipment

• Workforce availability limiting scan throughput

• Maintenance and calibration requirements that increase downtime risk

Opportunities are emerging in:

• Throughput optimization to reduce referral backlogs

• Network-wide standardization of protocols and training

• Improved workflow and data integration to support clinical reporting

Regional Outlook: England Leads, While Other Nations Expand Steadily

• England: 4.7% CAGR, driven by larger provider networks and higher scanning volumes

• Scotland: 4.2% CAGR, supported by structured osteoporosis care pathways

• Wales: 3.9% CAGR, shaped by practical capacity-building initiatives

• Northern Ireland: 3.5% CAGR, reflecting measured, staged investment cycles

Competitive Landscape: Reliability and Service Support Define Positioning

Competition in the UK bone densitometers market centers on scan accuracy, uptime, service coverage, and training support. Vendors are evaluated on their ability to deliver consistent results over the system lifecycle, supported by dependable calibration, software updates, and operator education.

Key companies active in this space include:

• GE Healthcare

• Hologic, Inc.

• Swissray International, Inc.

• DMS Imaging

• BeamMed Ltd.

As the UK healthcare system continues to emphasize fracture prevention and long-term bone health management, demand for bone densitometers is expected to grow steadily, anchored in operational reliability, standardized workflows, and integration into evidence-based care pathways.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Related Reports Insights from Future Market Insights (FMI)

EGFR-Mutated Lung Cancer Treatment Market https://www.futuremarketinsights.com/reports/egfr-mutated-lung-cancer-treatment-market

Small-molecule Respiratory Drugs Market https://www.futuremarketinsights.com/reports/small-molecule-respiratory-drugs-market

OTC Heartburn Drugs Market https://www.futuremarketinsights.com/reports/otc-heartburn-drugs-market

Dual Lumen ECMO Catheter Market https://www.futuremarketinsights.com/reports/dual-lumen-ecmo-catheter-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.